Remember when a plate of nasi lemak cost about RM2.50 about five years ago? Guess how much does it cost now to have a decent plate of nasi lemak? Nothing less than RM5? Now you would be wondering what happened, well the cost of goods and services is continuously rising and our very dear friend, inflation causes it. The current average inflation rate in Malaysia is somewhere between 2.5% to 4% for 2021 according to Bank Negara Malaysia.

Understanding what inflation means is quite vital, especially when the presence of COVID-19 will keep inflation at bay for the foreseeable future. The most common perception of inflation is when there is a price rise in goods and services. Nevertheless, what are the reasons that cause inflation to occur? There are plenty of reasons on why inflation takes place, however, today we are going to discuss the two major factors that play a role in a country’s inflation rate.

Demand-Pull Inflation

Demand and pull inflation is the most common cause of rising prices. It happens when a country provides high paying jobs for its citizens. When the people’s purchasing power increases, the demand for goods and services increases simultaneously too. This causes a strain in the supply chain in certain goods and services.

Whenever a product is bought or sold beyond it’s real price for it’s worth, inflation occurs. For example, a company produces a limited number of organic apples but it’s demand is high due to its quality, therefore the vendors tend to increase the price of the product.

Since purchasing power is high, consumers are willing to pay a high price to obtain it. This again leads to price hike and inflation called “Demand-Pull” inflation.

Cost-Push Inflation

The second cause mostly happens when there is a sudden shortage of supply combined with enough demand for goods and services that allows the producers to raise the prices. Cost-push inflation means the price has increased in any of the four factors of production, either labor, capital, land or entrepreneurship.

Again, taking the apples for example, since the demand for organic apples is high, the company is not able to keep up with the demand since their workers’ wages have increased. Therefore, the company has no choice but to increase the price of their product in order to maximize their profit margin and to be able to pay their workers.

However, many other factors could cause inflation to occur, but as for this article, let’s stick to these two causes.

How Can It Impact Savings

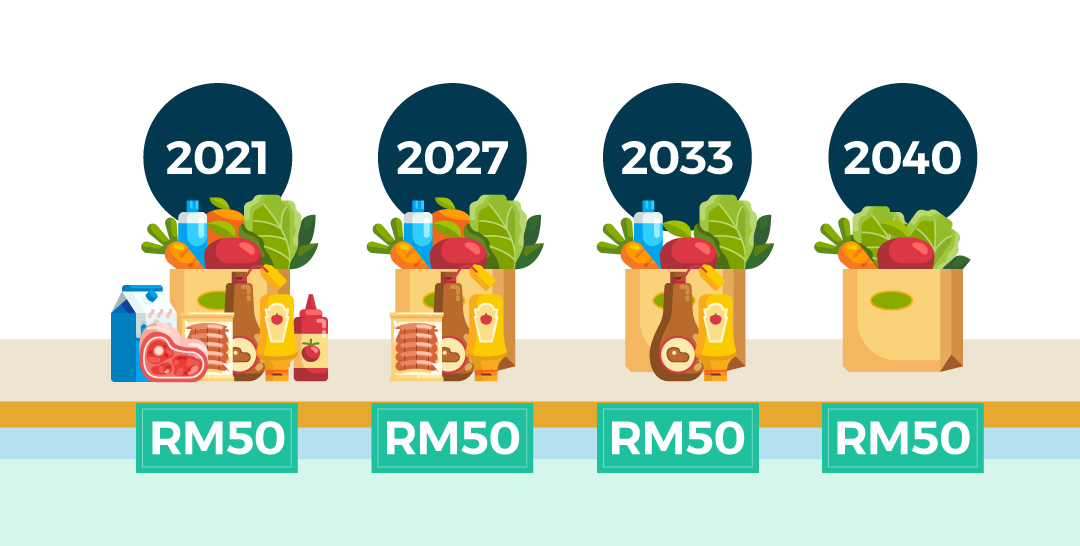

Over time, inflation can reduce the value of your savings because the price typically increases in the future. This can be seen with cash; if you keep RM10,000 under your bed, that money may not be able to buy as much 20 years into the future as you can today. Although you have not lost any money, you end up with a smaller net worth because inflation causes your purchasing power to reduce.

Is it possible to prevent inflation from occurring? Probably not, but that does not make you powerless.

How To Make Your Money Work For You Amidst An Inflation?

Investing in Stocks

If there is one sure-fire way to beat inflation over a long period, it is investing in stocks.

Taking the risk and putting your money in a diverse portfolio of stocks and bonds allows your money to grow much quicker than being idle in the bank account.

You should start investing earlier as you would have a more extended period to invest and learn from your mistakes. Time also plays a vital role in investing as the returns from investing generally magnifies over time.

Investing in Real Estates

Buy a property. Because real estates tend to maintain or increase over time, it has often been seen as a popular inflation hedge investment.

This also creates the opportunity for you to pass it down to your children or to use it to generate income later on. Rental and home value tend to hike up during inflation, thus having a property is a good idea as it could generate passive income. For more information on how to save money to get a property, check out this article.

Be Money Conscious

Inflation will always affect prices, so it is always wise to be thrifty.

Be wise when spending money, especially when using credit cards, as it is easy to overspend money, especially money that you do not have in your bank account. The last thing you want to be doing during an inflation is to repay your outstanding credit card loans.

Find ways to save money by carpooling, using public transportation, and even consider using rewards and discounts.

Opt For Online Financial Apps

There are also plenty of online apps you can use to set aside your money, such as Versa, a digital cash management platform that allows its users to earn interest rates similar to fixed deposits but provides the flexibility to withdraw the fund any time you wish without imposing a penalty.

Have Backup Plans

It is always good to have a backup plan in case things go south. You should budget your income and always have an emergency fund built. Look for incomes with steady cash flow and inflation-proof assets such as real estates and commodities.

Do not forget to sign up for a health insurance plan to beat the rising medical bills.

While inflation might not be inevitable, there are plenty of ways to prepare yourself from being affected by it. It is essential to equip yourself with financial literacy and prepare for the long run while incorporating simple tips into your monthly income.