Buying your first house can be exciting and equally nerve-wracking. It is, after all, one of the big-ticket purchases you’ll make in your life. Therefore, financial preparedness and commitment are essential here.

We will take you through the typical customer journey of buying a house:

Customer Journey

- Deciding to buy a house

- Discovery & Research

- Physical house hunting

- Make a decision and put a downpayment

- Wait for the house to be completed

- Take keys and Vacant Possession (VP)

- Defect Liability Period

- Renovation

- Move-in!

This article will show you how you can use Versa when saving for a house (steps 1-4) and help you figure out what kind of house you can afford with your budget.

Deciding to buy a house

To simulate this, we will make a few assumptions.

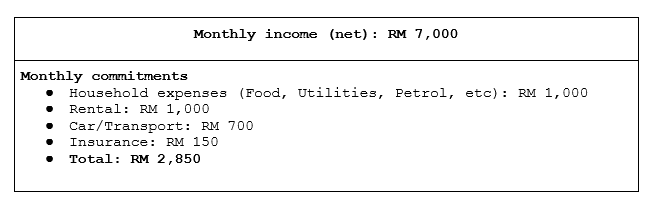

- First-time house buyer living in Kuala Lumpur

- Earning a monthly net income of RM 7,000.

- Decides to move RM 10,000 every month into Versa from his other investments (instead of a Savings account)

Timeframe: 6 months (until downpayment is made)

Figure out your financial situation

First, you’ll have to look at your financial situation to figure out what kind of house you’ll be able to afford.

- Monthly commitments

These are things that you’ll have to pay every month without fail. For example, your car loan, credit card bill, insurance, etc.

- Calculate Debt Service Ratio (DSR)

DSR = (total monthly commitments / net income) x 100%

Unless you are among the minor cash buyers, you will most likely apply for a house loan. So, you’ll have to calculate your DSR to determine if you can get the maximum home loan. Banks

The lower the DSR percentage, the higher the chance of getting a loan.

Here’s roughly how it works:

- DSR = (RM 2,850 / 7,000) x 100% = 40%

- If the bank lends you up to 70% of your DSR, this means you can use up to RM 4,900 (70% x RM 7,000) of your salary on your monthly debt

- Since RM 2,850 is spent on your monthly commitments, the maximum monthly mortgage the bank will borrow you is around RM 2,050 (RM 4900-RM 2850)

- Assuming it is a 35-year tenure at a 3.5% interest rate, the maximum home loan would be around RM 500,000

However, it may be best not to take the biggest loan available as you’ll want to consider other expenses that you might have in the long term.

Determine Minimum Monthly Income

In this case, with a net income of RM 7,000, the property price you can aim for would be around RM 500,000-RM 600,000. Once you’ve figured out your budget, it is easier to narrow down your choices. Then, you can start visiting showrooms and open houses to see which house fits you best.

How Versa can help

You may be wondering, where does Versa Cash come in throughout this part of the journey?

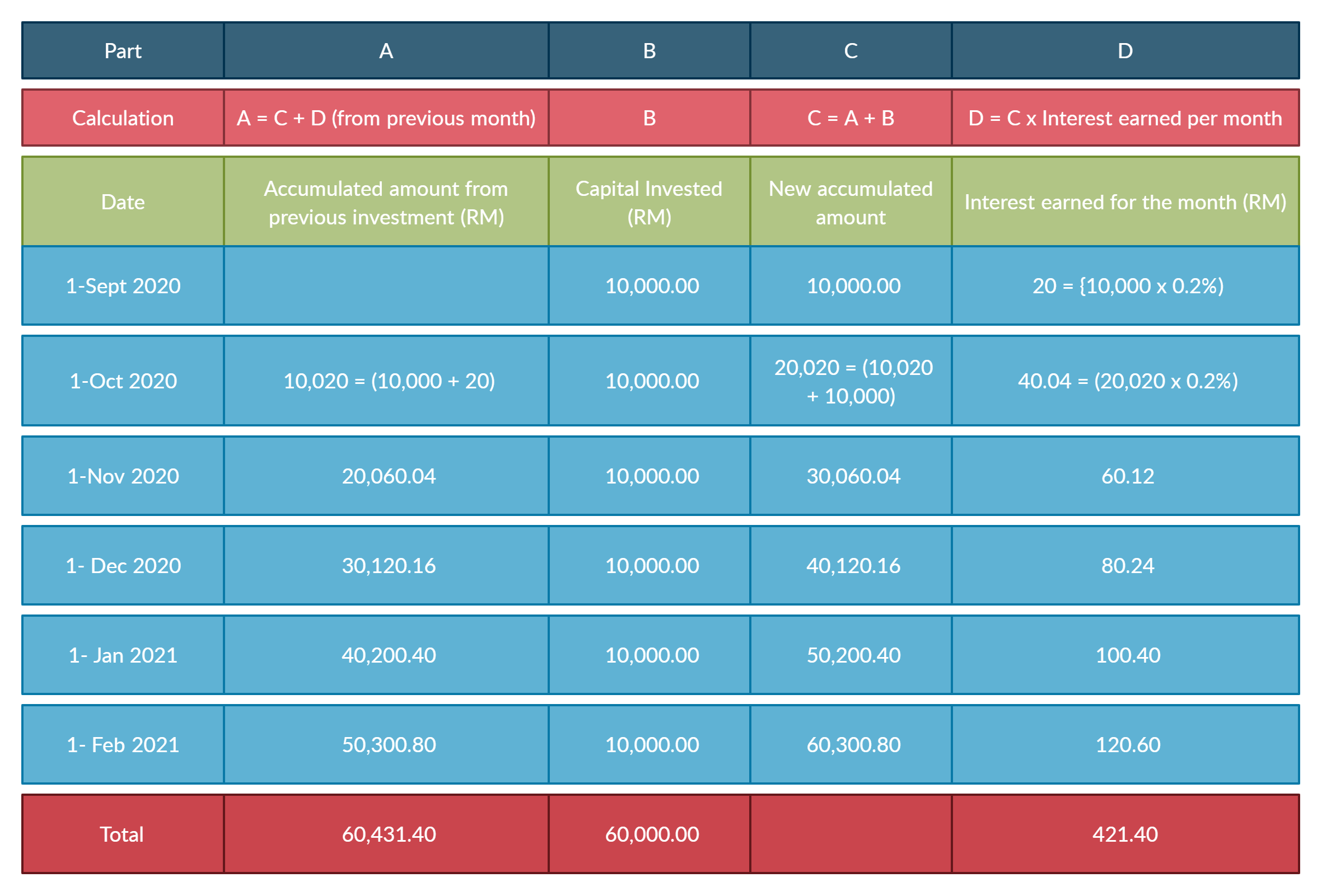

As mentioned earlier, we assume that you had put aside some money in Versa from the moment you decided to buy a house.

After an estimated time of 6 months, here is how much you earned with Versa Cash:

- Versa Cash’s EDF interest rate per annum(%): 2.40*%

- Versa Cash’s EDF interest rate (%) per month: 0.20*%

See how you were able to earn some interest while making this life-changing decision? As compared to a Fixed Deposit, for instance, you do not need to plan how much and how long to lock up your money for. You also have the option to withdraw your money anytime without any penalties! (For instance, when you find your desired unit and need to pay the booking fee ASAP!) We will talk more about how this will be particularly useful in the renovation stage later.

Make a decision and put a downpayment

Now that you have saved up money in Versa and have decided on a house, you can put the down payment.

500,000 x 10% = RM 50,000

Assumptions: you put 10% of the property price for the down payment

Note that this 10% is not fixed, you can pay more for the down payment to reduce your monthly installments.

After making the down payment, you’ll sign the SPA (Sales and Purchase Agreement) to complete the home purchase transaction.

In part 2, we will talk about how to use Versa once you get the keys to your new home to plan for renovation and other costs.

This article is the first part of our two-part series within the #SaveNowEnjoyLater campaign. Follow these tips and tricks to see how you can use Versa to make the most out of your sleeping cash for big life events!

*Projected Returns for 2022